🌎Macro#3) Chamath’s Simple Stock Strategy to Help Guide You During Inflation

Backtested with Tesla, Shopify, NASDAQ, and S&P, and it works!

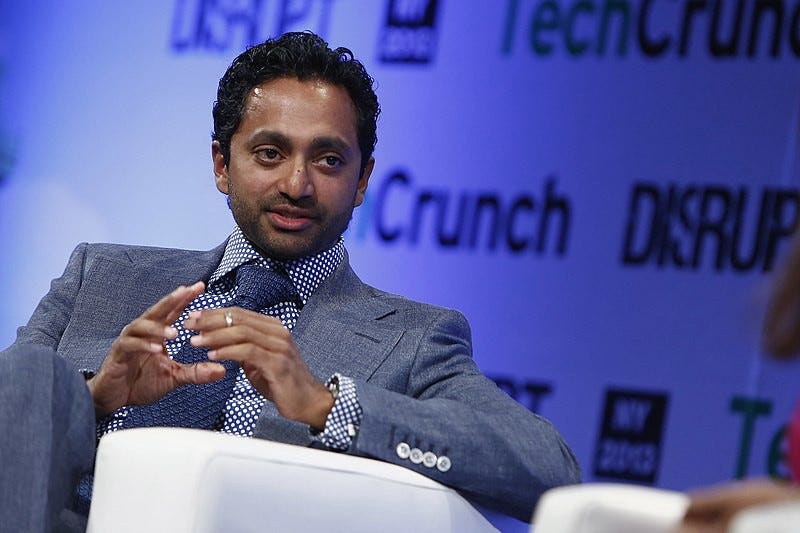

Chamath’s Simple Stock Strategy to Make a Ton of Money During Inflation

Backtested with Tesla, Shopify, NASDAQ, and S&P, and it works!

Investing during the inflationary period can be difficult, as the stock market is choppy. The S&P500 has returned a -13.6% and NASDAQ returned a -10.1% in the past year. Just when we thought there was doom in the stock market, the market has shown considerable strength recently. As a result, it is tough to predict the market's direction.

However, Chamath Palihapitiya, a legendary investor in Silicon Valley, has found a simple rule to gauge the best timing to buy and sell stocks.

Chamath’s simple stock strategy is to purchase stocks when the VIX (Volatility Index) is above 30 and short the market when it is below 20. He revealed the system in a recent episode of the All-In Podcast, a must-watch if you guys have not watched it yet.

It is systematically true that when the VIX is in the teens, you sell or short stocks. And when the VIX is in the 30s, you buy equity because you think it's the bottom. If you’ve been doing that for the past year you would have made a ton of money. — Chamath Palihapitiya, All-In Podcast 08/05/2022

Simply put, the strategy is to buy when everyone is freaking out and sell when everyone thinks the market is back. Sounds familiar? Yup, Warren Buffet said it as “be fearful when others are greedy.”

This article will look at the strategy and the potential returns you would have made if you followed this system.

What is the VIX?

The volatility index, a well-known indicator of the implied volatility of S&P 500 index options, has a trademarked ticker symbol called the VIX. It is frequently referred to as the fear gauge or the fear index, which indicates how much the market anticipates stock market volatility over the coming 30 days.

The VIX is calculated using several factors, including the price of options on the S&P 500 index. The higher the price of those options, the greater the implied volatility and the higher the VIX.

When markets are calm, the VIX will be low. When markets are volatile, the VIX will be high. Investors can use the VIX to gauge market sentiment and make investment decisions. For example, when the VIX is high, it may indicate that stocks are overvalued and that now is an excellent time to sell.

You can see that the VIX has been trending upwards since early this year and has crossed 30 a couple of times. In 2022, it happened 32 times.

Recently with the market showing strength and investors gaining confidence, the VIX is approaching the high teens.

Back-testing the Strategy with S&P500

Let’s try the strategy with the S&P500 and keep it simple by narrowing the scope to 2022/01~.

The below graph shows the S&P500 stock price, with blue dots showing sell signals and red dots indicating buy signals.

The statistics of this strategy are staggering!

Average buying price of S&P500 (red dots): $4,121.3

Average selling price of S&P500 (blue dots): $4,664.1

Average upside: 13.2%

I know what you are thinking: if you followed Chamath’s strategy, you could only sell on two timings: mid-February and mid-March.

Even if you did that, your return is 6.8%! You would not have lost money in this ridiculously choppy market. The results get more significant as the asset class becomes riskier.

Back-testing the Strategy with NASDAQ

Yet again, the chart looks great.

Average buying price of NASDAQ (red dots): $12,445.2

Average selling price of NASDAQ (blue dots): $14,896.8

Average upside:19.7%

Even if sold twice in mid-February and mid-March, your return is 8.4%! Slightly higher than the S&P500.

Back-testing the Strategy with Tesla

More volatility than the NASDAQ, but still, the chart looks impressive.

Average buying price of Tesla (red dots): $757.9

Average selling price of Tesla (blue dots): $1,083.7

Average upside:43.0%

Even if sold twice in mid-February and mid-March, your return is 26.5%. Not too shabby for a bear market.

Back-testing the Strategy with Shopify

Shopify has gone down from $130 to $40. A drop of about 75%, and still, if you had used this strategy, you would have been able to cut losses.

Average buying price of Shopify (red dots): $47.6

Average selling price of Shopify (blue dots): $101.0

Average upside:111.9%

Even if sold twice in mid-February and mid-March, your return is 14.3%. Can’t complain about a stock that has plunged about 3/4s.

Chamath keeps the investing strategy as simple as they come. One indicator, one action. The VIX seems to be decreasing (currently at 21) and may hit the teens again. So perhaps it will be the time to shed a few shares off your portfolio.

Of course, no investing strategy is perfect, and some risks will always be involved. However, this strategy may help you to avoid some of the pitfalls that can occur during periods of inflation. Investing is never easy, but hopefully, this article has provided some helpful guidance.

This is not financial advice. I am not a financial advisor, and you should do your research and not just listen to anyone on the internet. Nothing contained in this publication should be construed as investment advice.

Each morning, The Sample sends you one article from a random blog or newsletter that matches up with your interests. When you get one you like, you can subscribe to the writer with one click. Sign up here.